What is the Ponzi scheme? How was the Ponzi model born?

Ponzi, a Ponzi scheme or a Ponzi scheme are often referred to as a “notorious” scam that has been around for hundreds of years. Ponzi is used in many different forms, around the world and in Vietnam. Currently, there are many organizations and individuals using Ponzi to earn illicit profits from investors. So what exactly is the Ponzi scheme? How was it born and how to realize it? This article will give you an overview and correct view of the Ponzi scheme.

Table of content

What is the Ponzi scheme?

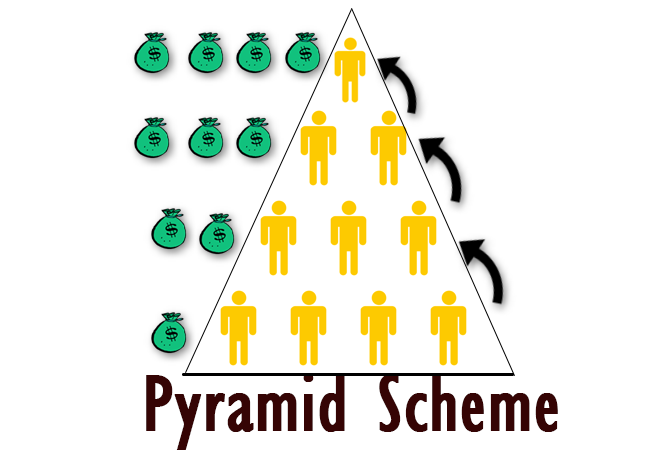

A Ponzi scheme is to borrow money from one person to repay another’s debt. The borrower makes a commitment to pay high returns to the lender. And advertise with them examples of high returns in the past to attract lenders. Lenders, attracted to high returns, refer even newer lenders. In this form, the borrower is getting larger and larger loans from more and more new lenders.

The owners of Ponzi schemes often attract new investors. By offering higher returns than other investments. With short-term returns that are either abnormally high or abnormally long.

The Ponzi scheme sometimes starts out as a legitimate business, until the business does not achieve the expected return. Business becomes a Ponzi scheme if it then continues to commit fraud. Whatever the initial situation, paying high returns requires an increasing inflow of money from new investors to sustain this pattern.

How was the Ponzi model born?

The Ponzi scheme is named after Charles Ponzi or Carlo Ponzi (pronounced in Italian), who famously applied the model in 1920. This idea appeared in the novels Martin Chuzzlewit in 1844 and Little. Dorrit in 1857 by Charles Dickens, but Ponzi did it in real life and made so much money that the model became famous throughout America. Ponzi’s original plan was to use an international payment coupon to pay stamps, but then he used money from latecomers to pay for himself and those who came first.

Charles Ponzi (March 3, 1882– January 18, 1949) was an Italian immigrant to the United States and became one of the greatest scammers in American history. He is the “ancestor” of multi-level credit fraud bosses, within 2 years (1919-1920), Ponzi raised $ 15 million a huge number at that time from tens of thousands of customers who were lose money through the “Ponzi scheme”. Although many people have never heard of the name Ponzi, the term “Ponzi scheme” is a well-known description of a system of deceptive “fast-forward” schemes carried out over the Internet and other places to this day. His aliases include Charles Ponei, Charles P. Bianchi, Carl and Carlo. (According: wikipedia.org)

Postal services at the time developed a global discount coupon that allowed mailers to prepay postage including fees from the respondent. The recipient can take the coupon to the local post office and exchange it for postage stamps and mail replies.

Postage stamps prices fluctuate and in some countries, postage stamps are higher than others. Ponzi hired agents to buy coupons for postage stamps in cheap countries and send them to him. After that, he exchanged these coupons for postage stamps in expensive places and sold them. So there is profit.

This form of buying and selling is in technical terms called Arbitrage, and is considered illegal. Ponzi then became greedy and extended her efforts. Taking the name of his company, the Securities Exchange Company, he promised a return of 50% in 45 days and 100% in 90 days. Seeing him successful in the postage stamp business, the investor was immediately attracted. However, instead of investing money, Mr. Ponzi just brought it to pay interest for the old and took the rest as a profit. This model lasted until 1920 until it collapsed because of an investigation into his company.

How to recognize the Ponzi pattern?

The concept of the Ponzi scheme did not end in 1920. Technologies changed and the Ponzi model changed. In 2008, Bernard Madoff was accused of using a Ponzi scheme to generate fake transaction reports to prove to investors that his hedge fund was profitable.

Regardless of the type of technology used to operate the Ponzi scheme, the scams that use this model have similar characteristics such as:

- Commitment to high returns with less risk;

- Profits are stable no matter how volatile market conditions;

- Investment forms are not registered with reputable authorities;

- The organization’s investment strategies or forms are either confidential or described as intricately;

- Clients are not allowed to view official documents for their investments;

- It is difficult for customers to withdraw money from the organization.

Maybe you are interested:

Official information channel of HyipOk.com

- Telegram: @hyipok

- Group Telegram: https://t.me/HyipOk_enChat

- Fanpage facebook: HyipOk – Hyip Review

Leave a Reply